Presuming there is a 10% job rate, the gross annual income is $10. 8 million ($ 12 million x 90%). A similar approach is used to the net operating income method, also. The next step to assess the value of the real estate home is to identify the gross earnings multiplier and multiply it by the gross yearly earnings.

Looking at the prices of equivalent homes and dividing that value by the created gross yearly earnings produces the average multiplier for the region. This type of assessment approach is comparable to using similar deals or multiples to value a stock. Numerous experts will anticipate the profits of a business and multiply its earnings per share (EPS) by the P/E ratio of the industry.

Both of these real estate evaluation approaches seem fairly basic. However, in practice, identifying the worth of an income-generating residential or commercial property with these calculations is relatively made complex. First of all, it might be time-consuming and tough to obtain the required details relating to all of the formula inputs, such as net operating income, the premiums consisted of in the capitalization rate, and comparable sales information.

As a result, more analysis should be conducted to anticipate and factor in the possible effect of changing economic variables. Because the home markets are less liquid and transparent than the stock exchange, sometimes it is hard to get the essential info to make a completely notified investment decision. That stated, due to the big capital investment typically needed to purchase a big development, this complicated analysis can produce a big reward if it causes the discovery of an undervalued home (similar to equity investing).

Real estate appraisal is frequently based on methods that are similar to equity analysis (what is a real estate novelist). Other techniques, in addition to the reduced NOI and gross earnings multiplier method, are likewise regularly used. Some market experts, for instance, have an active working understanding of city migration and development patterns. As a result, they can determine which cities are more than likely to experience the fastest rate of appreciation.

3 Simple Techniques For How To Find A Good Real Estate Agent

As a business realty broker, investor, and developer, I get asked by brand-new investors all the time: How do you find many investment chances? There aren't any offers out there!And, for the majority of financiers, that statement is real. Buying commercial realty can be a great deal of enjoyable and it's definitely gratifying, but coming across a good deal is often the most frustrating part of this process.

Here's my beginner's guide to finding business property deals (what are the requirements to be a real estate appraiser). If you're not taking the best technique when it concerns, then you're currently behind. You can't just make a post on Facebook, reveal what you're looking for as soon as at an investor event, or tell the occasional property representative you discover.

Like I said - announcing it once then tossing your hands up in the air in defeat when no deals fall in your lap can not be your strategy. A few of the most effective genuine estate financiers I have actually ever fulfilled connect to their database on a constant basis to let everybody understand what they're searching for.

You never understand what you'll find in an offer that others have actually just missed. Be prepared to turn over every stone - even if something has actually been resting on the market for a while and "everyone has actually seen it and handed down it" does not imply there isn't opportunity there. Finance every opportunity that comes your way because they might be scarce depending upon your financial investment criteria.

Searching for industrial residential or commercial properties? Whether you're an investor, broker, or service owner, here are the 7 best methods of finding industrial deals. Industrial property brokers are most likely your best choice when on the hunt for business home since they're doing some, if not all, of the other methods I'll note below.

Indicators on What Is A Real Estate Developer You Need To Know

The world of business property is often shrouded in secret considering that there is no single database that preserves, tracks, and lists all of the available opportunities like you'll discover with the MLS in property genuine estate. So, these brokers work their hardest to keep a running list of any present and approaching accessibility so that they can work to combine buyers and sellers together.

Again - because there's no database, you'll http://louisrhko685.iamarrows.com/fascination-about-what-is-noi-in-real-estate need to deal with your own. Get to understand other real estate owners in your neighborhood or the location you're looking to obtain home in by networking at industry occasions or area conferences. Let them understand that you're on the look for industrial investments.

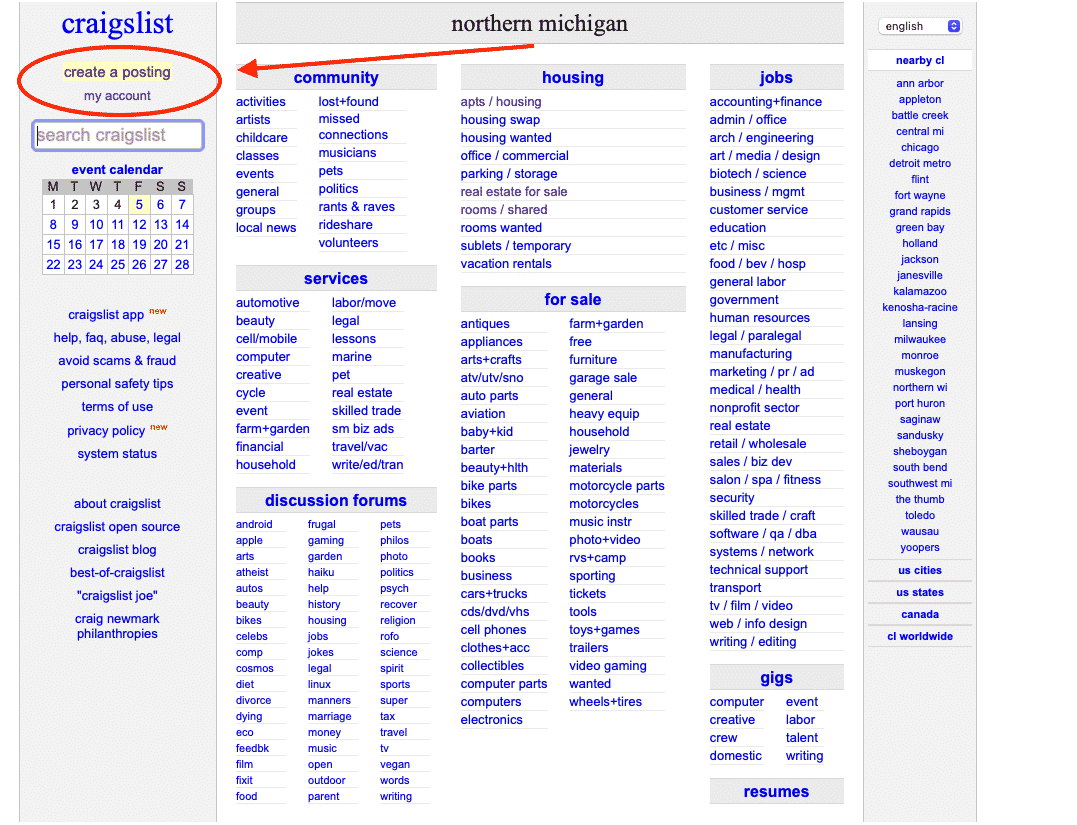

I have actually seen residential or commercial property trade hands off market like this sometimes before - the purchaser fulfilled somebody at an event that so occurred to be thinking about selling something (how to get into commercial real estate). Social media is essentially a digital bulletin board system - benefit from that!Not only can you post what you're looking for on your page, you might likewise share it with likeminded groups where you'll discover potential sellers or people that understand other owners ready to sell.

Social network is among my favorite approaches for getting ahold of a decision maker, especially if a business owns its own place, given that the ownership or a manager is frequently running their social accounts." Cold calling is dead!" For some cases, it certainly is. But if you're aiming to get ahold of a homeowner, it can be a direct course to the seller.

LinkedIn is perfect in this situation given that contacts will typically have their telephone number on their profile page after you've connected. Then, call on them and just ask if they're interested in offering the residential or commercial property. They may not have an interest in offering at that time, however circumstances can alter quickly, so have them keep your number just in case.

The 7-Minute Rule for How To Find A Real Estate Agent

Most financiers (and people in general, for that matter) don't even believe to make the most of this method. It can be impossible sometimes to find the proper owner in commercial property since these ownership entities are frequently concealed behind the barriers of Browse this site an LLC or through the office of a property lawyer.

Physical mail has actually likewise reduced in Check out the post right here popularity because the development of email, so send those letters and postcards to owners and yours may be among the couple of pieces of mail they get frequently. In some cases there's no better method to find investment opportunities than driving around in the market. I watch out for homes that look as if they're falling apart, the landscaping hasn't been looked after in quite some time, or the earliest structure on the block.

Get out, knock on the door, and talk to the owner if they're onsite. If not, follow up with a sales call and a letter!As an investor, you must get in the routine of driving your market as frequently as possible. Not just will you continue to increase your familiarity with the areas you're looking to buy in, however you'll also start to recognize which residential or commercial properties have changed hands or which pockets appear to be acquiring traction.